(Jared Dillian is the editor and publisher of The Daily Dirtnap, investment strategist at Mauldin Economics, and the author of Street Freak. This column appeared on the NDTV website on August 25, 2021)

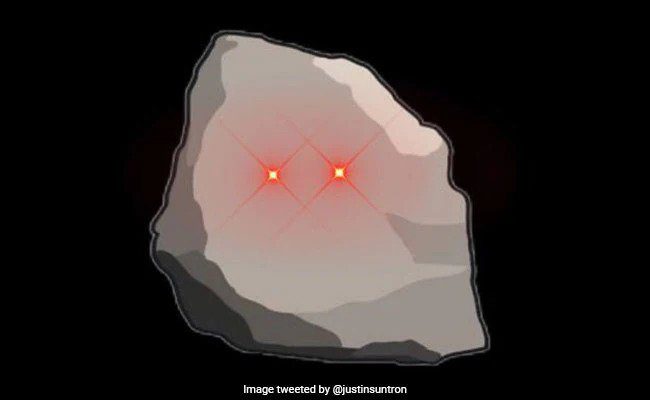

- A few nights ago, cryptocurrency entrepreneur Justin Sun announced on Twitter that he had paid half-a-million dollars for a picture of a rock with laser eyes. It wasn’t even a good picture of a rock. It had little to no artistic merit, like most of the non-fungible tokens, or NFTs. Whether it’s the original cryptokitties, or the penguins wearing hats, or the rocks, it is all crypto-community internet kitsch, a big inside joke that none of us are supposed to get except for the cool crypto kids. The geeks buy and sell these “assets,” driving prices up to unsustainable heights, while the rest of us just shrug. We just don’t get it, they say. I get it perfectly well. First, NFTs are an incredible innovation that might be even more important than the cryptocurrencies they are based on. NFTs establish property rights in the digital sphere where none had previously existed. U.S. copyright law provides for what is called the “first sale doctrine,” where it is “legal to resell or otherwise dispose of physical copies of copyrighted works,” according to Katya Fisher, writing in the Cardozo Arts & Entertainment Law Journal. Up until this point, no such protections existed in the digital realm, as digital copies of a work of art were considered to be fungible, and that a digital first sale right could not exist with digital works due to their fungibility. If one buys a physical painting, that person just bought the painting, not the rights to reproduce that painting. NFTs operate in much the same way…

Also Read: How Gupta Brothers of Saharanpur caused turmoil in South Africa: India Today